Integrated Reporting Framework (IReF)

Paradigm shift in regulatory reporting – Are you ready?

A new standard for banking regulatory reporting

Banking reporting is facing a paradigm shift: With the ECB's Integrated Reporting Framework (IReF), the previously aggregated reports will gradually be replaced by the reporting of granular data. From 2029, IReF will become mandatory and will initially replace the European guidelines for statistical reporting such as BSI, MIR, SHS-S, and AnaCredit – with uniform frequency, higher data granularity, and simplifications for smaller institutions.

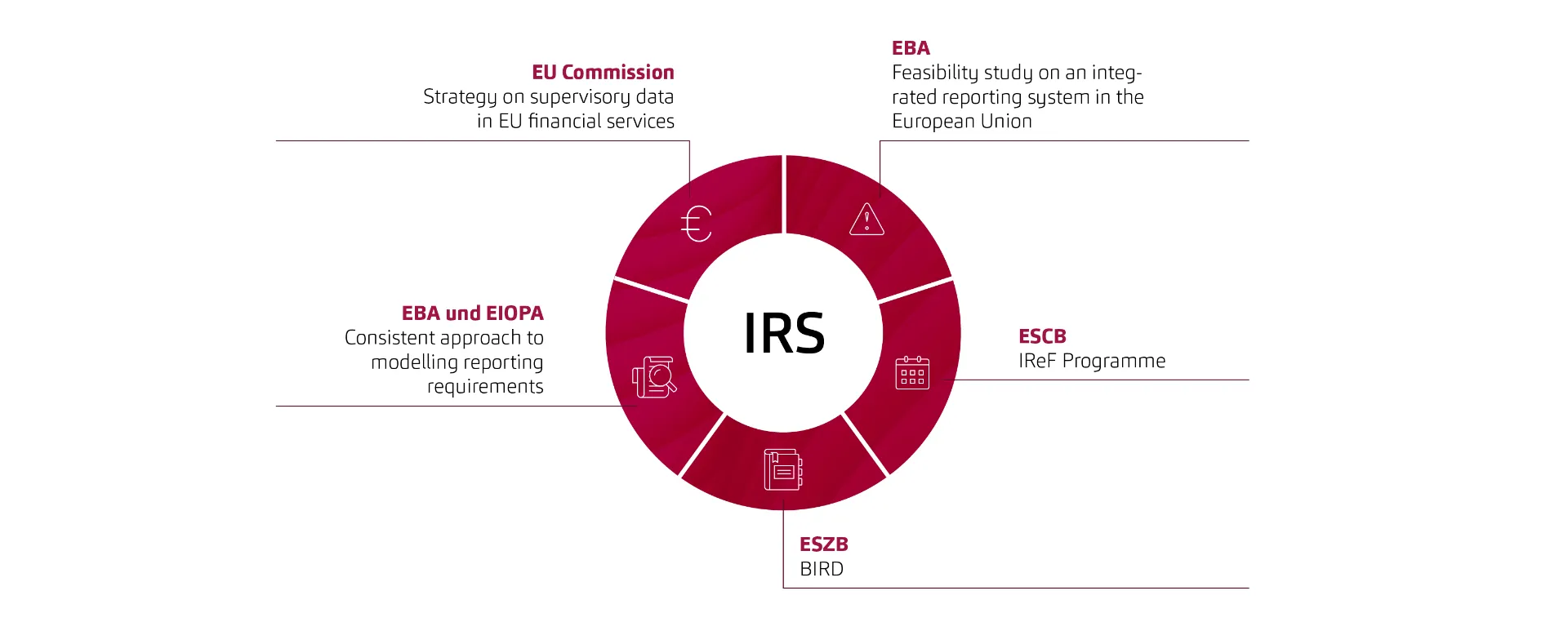

In addition, European supervisory authorities have developed a target vision with IReF as part of the integrated reporting system (IRS), which will continue to have a significant impact on banks. In the future, regulatory reports such as FINREP, COREP, and resolution reporting, among others, are to be included in the integrated reporting system in addition to statistical reports.

New challenges in regulatory reporting

The introduction of IReF requires comprehensive adaptation of systems and processes. Key challenges include:

The coexistence of template-based and granular regulatory reporting must be as frictionless and efficient as possible, and the IRS must already be taken into account in the solution approach in further expansion stages.

The high data volumes for granular reporting must be processed efficiently in all process steps, and appropriate scaling options must be provided.

Data quality checks and appropriate correction options ensure that data quality is generated as early as possible in the process chain. Manual corrections at the end of the process chain will no longer be possible in the future.

In the future, central methods will still need to be integrated in order to enrich the input data in accordance with regulatory requirements: these include collateral distribution, exposure calculation, RWA calculation, SA-CCR calculation, etc.

IReF enables banks to strategically realign their financial architecture for regulatory reporting and risk management—for better control, greater flexibility, and lower development costs.

Due to dependencies in the reporting system, an IReF solution should be easy to integrate into the existing reporting system. The integration must be based on a common data model that is compatible with BIRD (the Banks’ Integrated Reporting Dictionary, which provides clear definitions for reporting requirements for banks in the euro area), but still includes all information for other statistical and regulatory reporting and data for settlement. All solutions for generating the required reports are based on this common data model.

The necessary high investments in the coming years will only be worthwhile if the future reporting solution offers banks additional added value, such as analysis options, KPIs, easy access to data, support for BI solutions, management dashboards, simple reporting, automated processes, or the use of data for AI evaluations by banks.

Our solutions for your institution – your answer to IReF

Our product strategy with ORRP (Open Risk and Reporting Platform), ELIDA (Uniform Logical Integrated Data Architecture), and BAIS (Banking Supervision Information System) is fully aligned with the requirements of IReF and enables you to implement IReF quickly and efficiently.

ORRP

- IReF is fully implemented in ORRP

- Cloud & distributed data storage for scalability and performance

- Easy integration of central methods into the ORRP architecture

- BI connection & Visual ORRP for flexible reporting

- Automatic data quality check of input data

ELIDA

- ELIDA: integrated data model for overall bank management

- Future coverage: BIRD/IReF, EBA, SRB, ESG, and national regulatory reporting

- Bank management information included

- Compatibility: Data Lineage ELIDA → BIRD → IReF

- Data intake & master data correction via ELIDA

BAIS

- Easy connection of existing systems and seamless integration into the regulatory reporting system.

- For BAIS users, data intake can optionally continue in the familiar BAIS interface format.

- After correction, the data is transferred to the BAIS database via an adapter, where it is consistently available for the remaining reports.

msg's IReF community for banking

Take advantage of this opportunity to engage in early and regular dialogue with experts in the IReF community about the latest developments in IReF and the challenges facing institutions.

Key factors for successful implementation of IReF

During implementation, it is crucial to keep the strategic goal of integrated reporting in mind. The following factors are key to success:

Integrated data management:

Integrated data management:

The aim must be to establish integrated data management for all reporting-relevant data (statistics, banking supervision, ESG, SRB).

Speed:

Both the provision of the data to be reported in the input interface and the creation of the report must be fast and efficient.

Scalability:

The regulatory reporting solution must be scalable in terms of data and performance.

High data quality:

High data quality must be ensured right from the input stage. Documenting the data in a data dictionary and data lineage is another key success factor.

Organisational adjustments and new technologies:

The successful implementation of IReF requires comprehensive adjustments to internal processes and structures, including organisational changes and new technologies to handle granular data collection and processing.

Investments and strategic opportunities

The implementation of IReF involves considerable investments, which may not be fully offset by the anticipated simplifications in supervision.

‘However, IReF is exactly the right time to strategically realign your financial architecture for regulatory reporting and risk management.’

Take advantage of opportunities offered by IReF

Link IReF with internal convergence: a shared data repository including DQ management for reporting and risk management. By consolidating internal and external reports and using new technologies, you can leverage your investments in IReF and achieve better control, greater flexibility and lower development costs.

Your IReF implementation – customized support from our IReF services

For the IReF analysis, we offer two service packages that can be selected individually or as a whole and adapted to specific customer requirements. These services serve to initially assess the current situation and then determine the next steps.

Automation check

Comprehensive process audit of the relevant process chains and systems in terms of processing time, process efficiency, and cost-benefit analysis, with the aim of process mapping and introducing new technologies such as machine learning and artificial intelligence.

Data Quality Check

Comprehensive data quality audit focusing on reviewing data governance, data quality tools, data quality metrics, and comparing FINREP/AnaCredit reporting (template-based vs. granular reporting)

Your contact persons

is responsible for the further development of the reporting software msg.ORRP/BAIS and supports the implementation of new regulatory requirements such as CRR III and IReF.

advises banks on the technical implementation of regulatory requirements with a focus on CRR III and the future of reporting under IReF/BIRD.