Financial Risk & Analytics

Quantitative risk measurement – expertise for ICAAP and IRBA

Focus on quantitative risk measurement

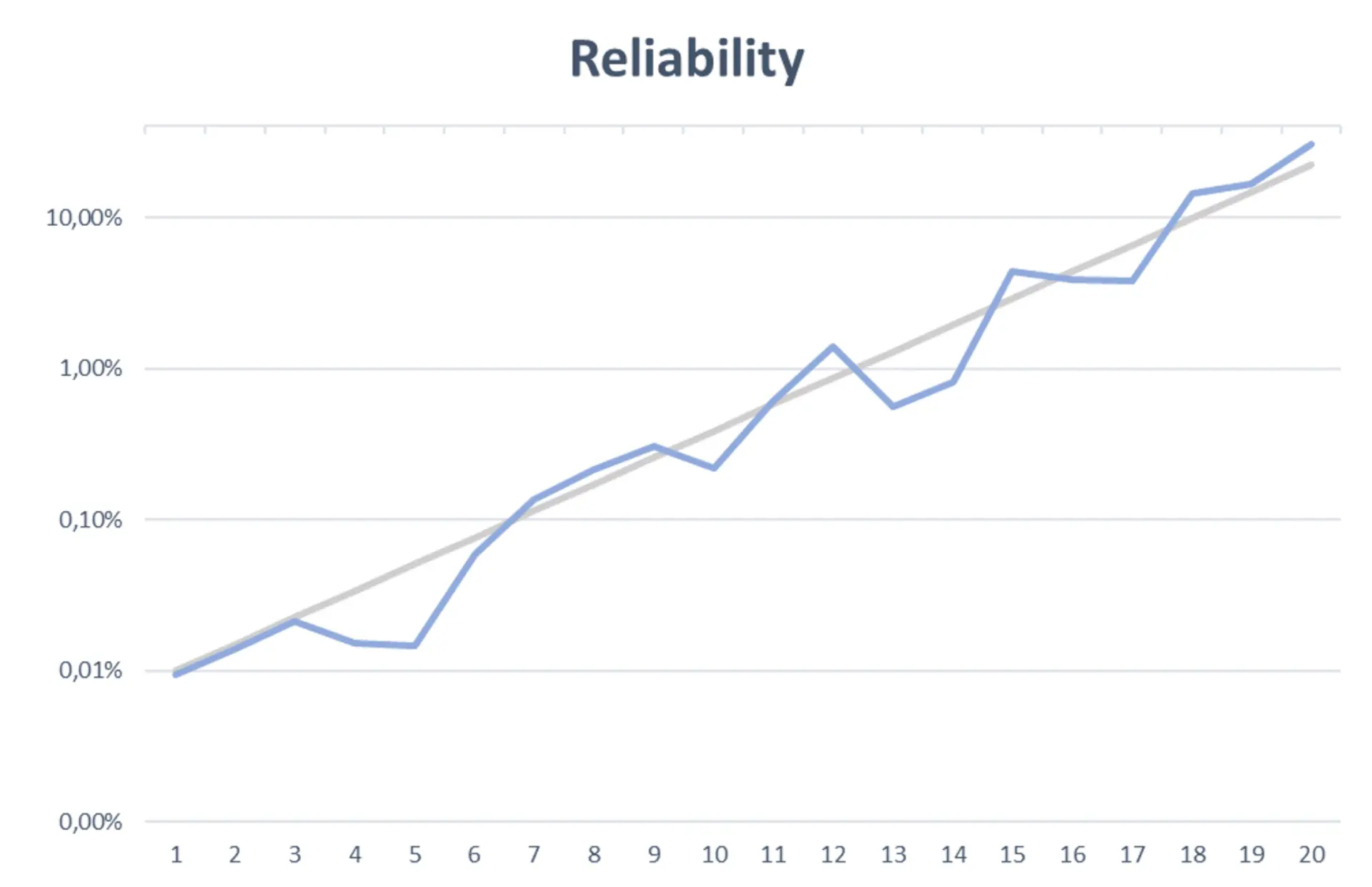

Quantitative methods are at the heart of risk measurement. The IRBA focuses on estimating the parameters PD, LGD, and CCF, and in particular on demonstrating their appropriateness, taking into account representativeness, selectivity, and calibration.

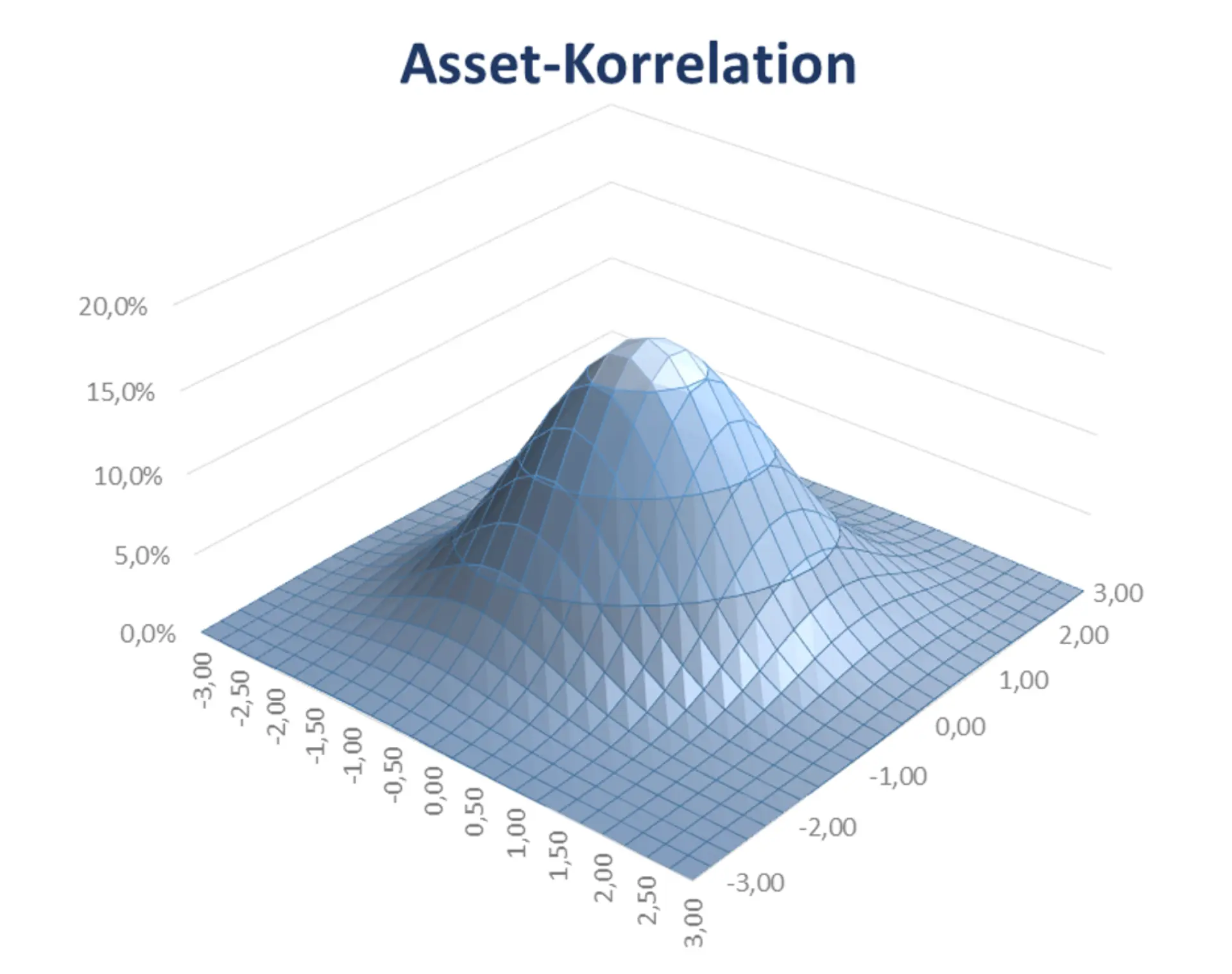

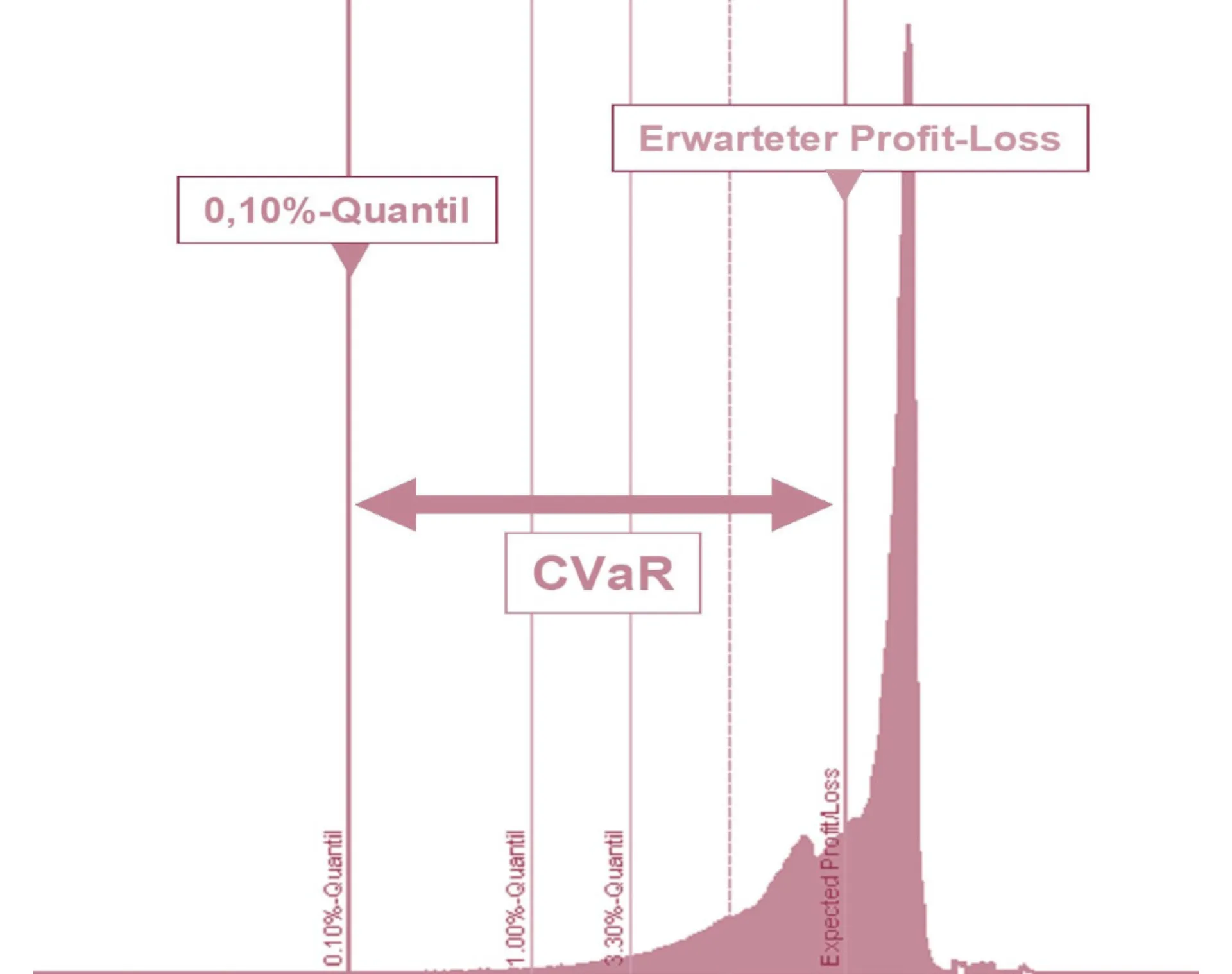

Quantitative methods are also essential in Pillar 2 within the framework of the ICAAP, such as risk measurement methods such as Monte Carlo and historical simulations, variance-covariance approach, and scenario assessment.

Benefit from our many years of experience in supporting SI and LSI institutions with IRBA applications and ongoing IRBA reviews, parameter estimation, and ICAAP. Our experts combine many years of experience with expertise in current procedures and requirements, as well as the ability to communicate in a manner appropriate to the target audience.

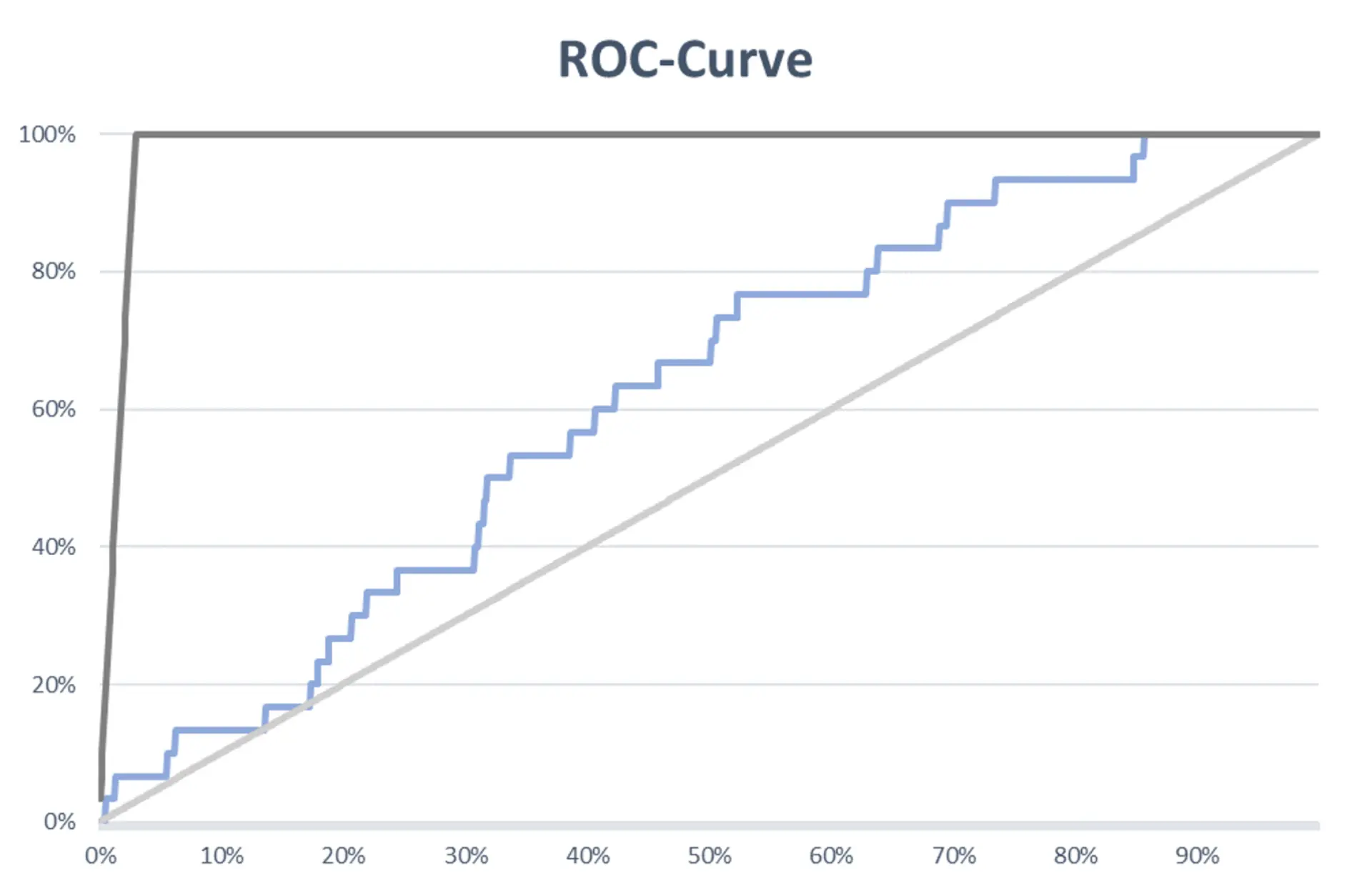

Validation

Parameter estimation

Risk tolerance

- ICAAP / Risk-bearing capacity / RWA optimization

- Credit portfolio models and credit risk parameters

- IRBA

- Validation

- Audits (revision / supervision)

- Many years of experience in risk management and regulatory audits

- Efficient project approach through the use of proven methods and templates

- Extensive project references and benchmarks

- Development of IRB models PD, LGD, CCF Retail for SI

- Implementation and validation of ICAAP in LSI

- Implementation of IFRS 9 (impairment) in SI

- Reichenberger, Schieborn, Vorgrimler (2021): Interpretability of machine learning methods in credit risk measurement, Zeitschrift für das gesamte Kreditwesen

- Puckhaber, Schieborn, Vorgrimler (2023): Capital relief through optimized use of the IRBA under CRR III, Die Bank 6/2023 (2023)

Validation as a Service

Validation as a Service is the answer to increasing regulatory requirements amid conflicting pressures of costs, competition, and skills shortages.

Your contact person

As Head of the Financial Risk & Analytics department, he is responsible for the design, consulting, and development of banking control, risk management, and calculation.