Validation as a Service

Validation of counterparty credit risk up to ICAAP and monitoring

What is Validation as a Service?

Validation as a Service is the answer to increasing regulatory requirements amid cost and competitive pressures and a shortage of skilled workers.

Effective validation of default risk with msg for banking

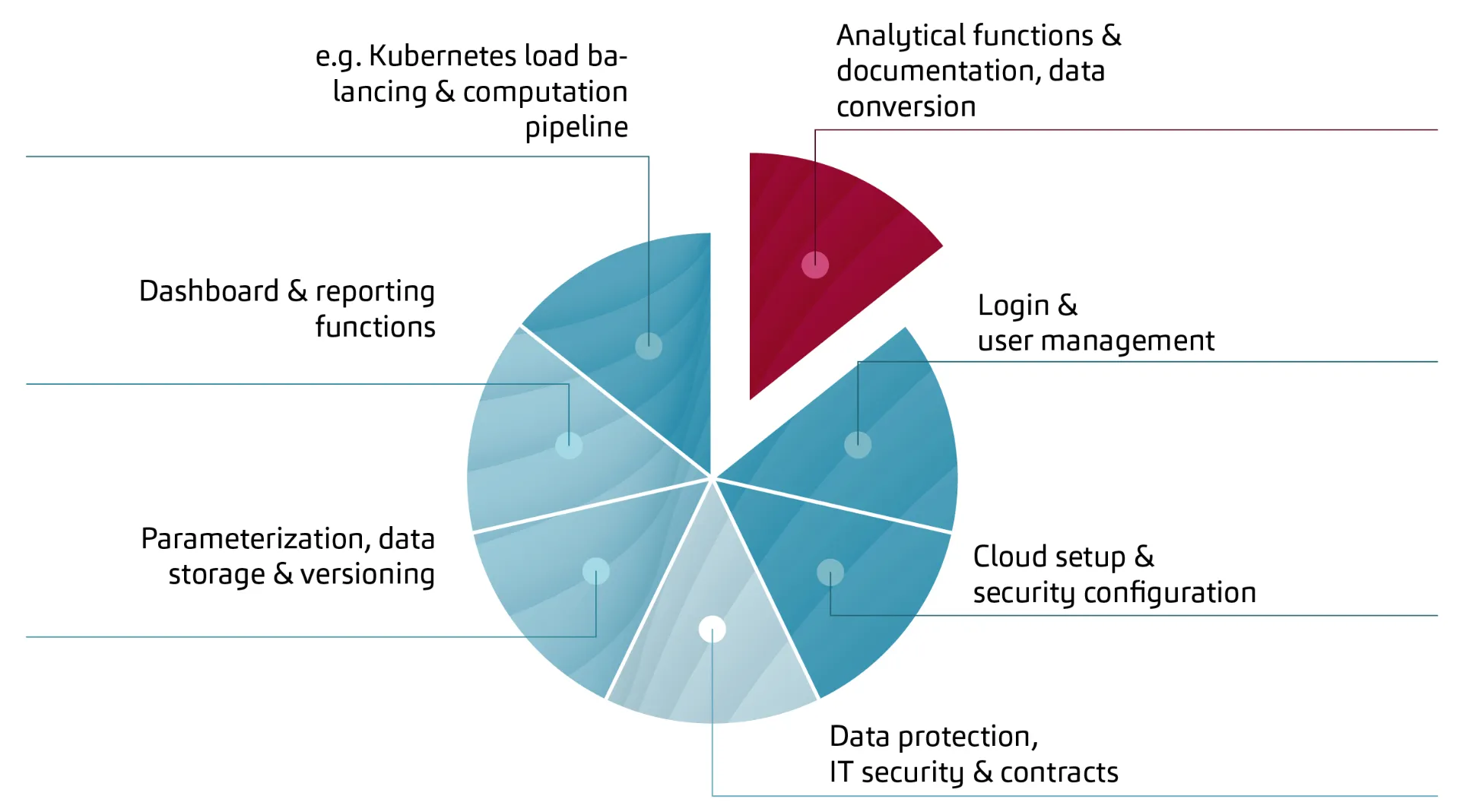

Thanks to standardized IT architecture supported by common hyperscalers with a modular structure, banks can effectively use our methodology for validation in the context of counterparty default risk up to ICAAP and monitoring. Review of estimates, model estimates, and benchmark models can also be quickly integrated.

In addition, institution-specific requirements can be integrated quickly and cost-effectively. The environment is scalable and independent of in-house IT restrictions, while taking into account the legal requirements of banks for secure IT operations, outsourcing, and data protection.

Further advantages of our tool include clear dashboards and updatable reports in the corresponding corporate layout, as well as the provision of analysis results at the data record level.

Benefit

- Validation: Compliance with regulatory requirements and efficient validation with a high degree of automation

- Cost-efficient implementation with high quality standards and the potential for easy expandability

- Monitoring: Fast and reliable detection of data anomalies over time

- A strong cooperation partner with professional and technical expertise

Tool performance

- Clear and customizable dashboards and Word reports (corporate layout of the institute and updatable during iterations)

- Flexible expandability of the methodology to meet institute-specific requirements, including modern machine learning

- Multicloud support for Google Cloud, AWS, and Azure

- Data preprocessing and evaluation, as well as data quality monitoring

- Industry standards in validation

- Top-down findings lists and traffic light aggregation, as well as summaries of validation dimensions

Your contact person

As Head of the Financial Risk & Analytics department, he is responsible for the design, consulting, and development of banking control, risk management, and calculation.