Don't miss out on opportunities in the cloud

The future of banking lies in the cloud. But if banks don't want to miss out on the digital transformation, it's high time they got to grips with this topic.

To ensure that your bank's transformation is quick and cost-efficient and that you can take full advantage of the opportunities and possibilities offered by the cloud, you need a partner at your side who can provide you with expert support in all aspects of cloud transformation – from infrastructure, systems, processes, and people to regulatory, data protection, IT security, and compliance.

Thanks to our expertise in both banking and IT, our experts can provide you with comprehensive advice on all aspects of cloud transformation and accompany you on your journey to the cloud.

Study: “Cloud technology in the banking sector”

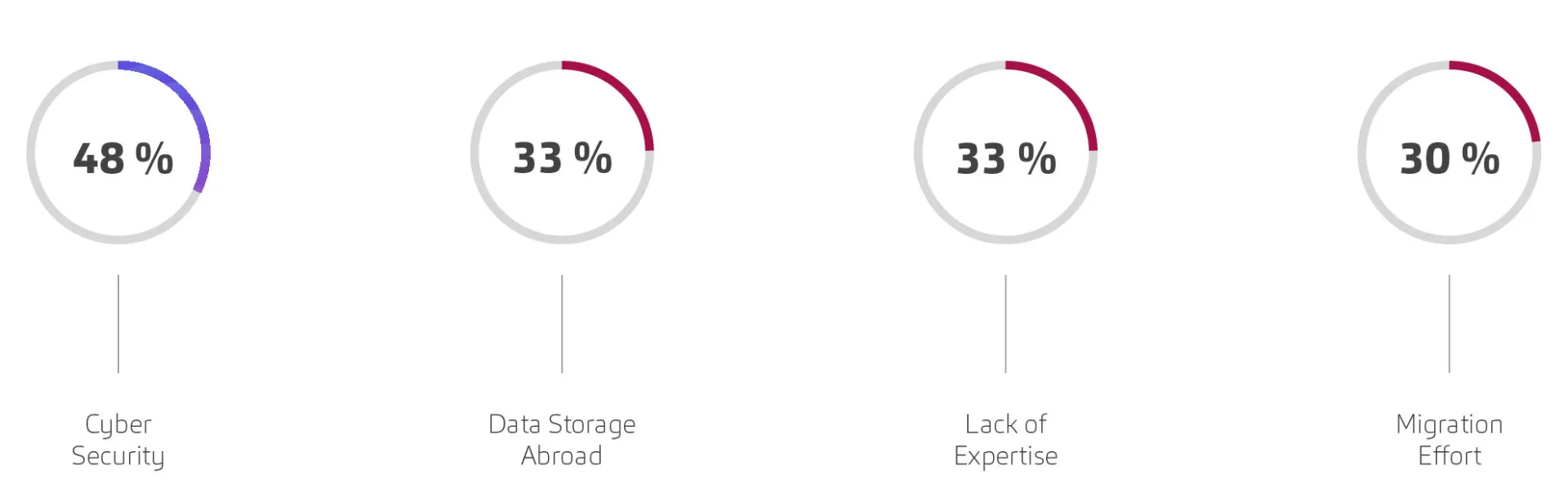

In your opinion, what are the biggest hurdles for your institution in introducing cloud technologies?

Successful cloud transformation in just a few steps

A cloud transformation involves much more than just introducing new technology. It involves looking at the bank as a whole — i.e., moving applications to the cloud, including the migration of applications, data, software, and even the entire IT infrastructure — in line with your bank's business objectives.

This includes an analysis of your business processes, your security and compliance requirements, the potential impact on your cost plan, and an overview of your IT architecture. By clearly defining your goals and requirements, you can ensure that your bank's cloud transformation delivers the desired benefits and meets expectations.

In addition, the involvement of your employees in the transformation project is a key success factor. Only early involvement and targeted preparations and training ensure that the transformation is supported and actively driven forward by everyone in the company.

Our recommendations

Develop and define your individual cloud strategy, describing, among other things, what goals you want to achieve with the cloud, what technical aspects need to be considered, what risks need to be taken into account, and which systems should be transferred to the cloud and for what purpose. Also clarify how the cloud will affect your organization, existing workflows and processes, and your IT and business strategy.

Get an overview of your bank's organizational and technical business processes. This will help you identify areas where adjustments are needed or skills need to be developed in order to effectively leverage the benefits of the cloud.

Check what measures are in place at your bank to ensure the security of people, data, and systems, and what compliance requirements apply. This will help you identify the cloud model that is right for your bank.

Create a cost plan that takes into account running costs, future investments, and potential changes. This will help you keep track of your costs and estimate potential savings.

Get an overview of your bank's IT architecture. This will help you identify the scalability, availability, and performance requirements that an optimal cloud solution must meet for you.

Our focus

We are banking experts and combine a high level of industry expertise with in-depth technical knowledge. Our cloud consulting services focus on:

- Cloud strategy

- IT risks

- Outsourcing risks

- Regulatory requirements

- Security and compliance

Cloud readiness check: We help you find the best way to move your bank to the cloud

From inventory analysis to a customized cloud strategy: With our Cloud Readiness Check, we offer you individual consulting services and the opportunity to take a big step toward optimal cloud transformation for your bank with minimal effort.

In the Cloud Readiness Check, we work with you to take a look at your status quo and the specific needs of your bank. We weigh up potential solution scenarios against their respective advantages and disadvantages and provide you with practical recommendations for action. You will also receive a cost estimate of the expected expenses and subsequent operating costs. Take advantage of this opportunity to get an initial overview!

Cloud in banking: Security First

Cloud security is the key factor for decision-makers

Download whitepaper for free!

Current articles on the topic of cloud on Banking.Vision

Cloud and banks

Cloud technology is a key prerequisite for successful digital transformation - and thus for securing long-term competitiveness. This also applies to banks. In this series, our experts analyse how the journey to the cloud can be a success for banks and what advantages, opportunities, benefits and risks cloud technologies bring for banks.

Contact

heads the Artificial Intelligence division at msg for banking and advises clients on process digitization and artificial intelligence in the financial sector.

is responsible for specialist architectures and processes in the area of digital transformation and advises on issues relating to overall bank and risk management as well as regulatory topics.