Banking.Vision

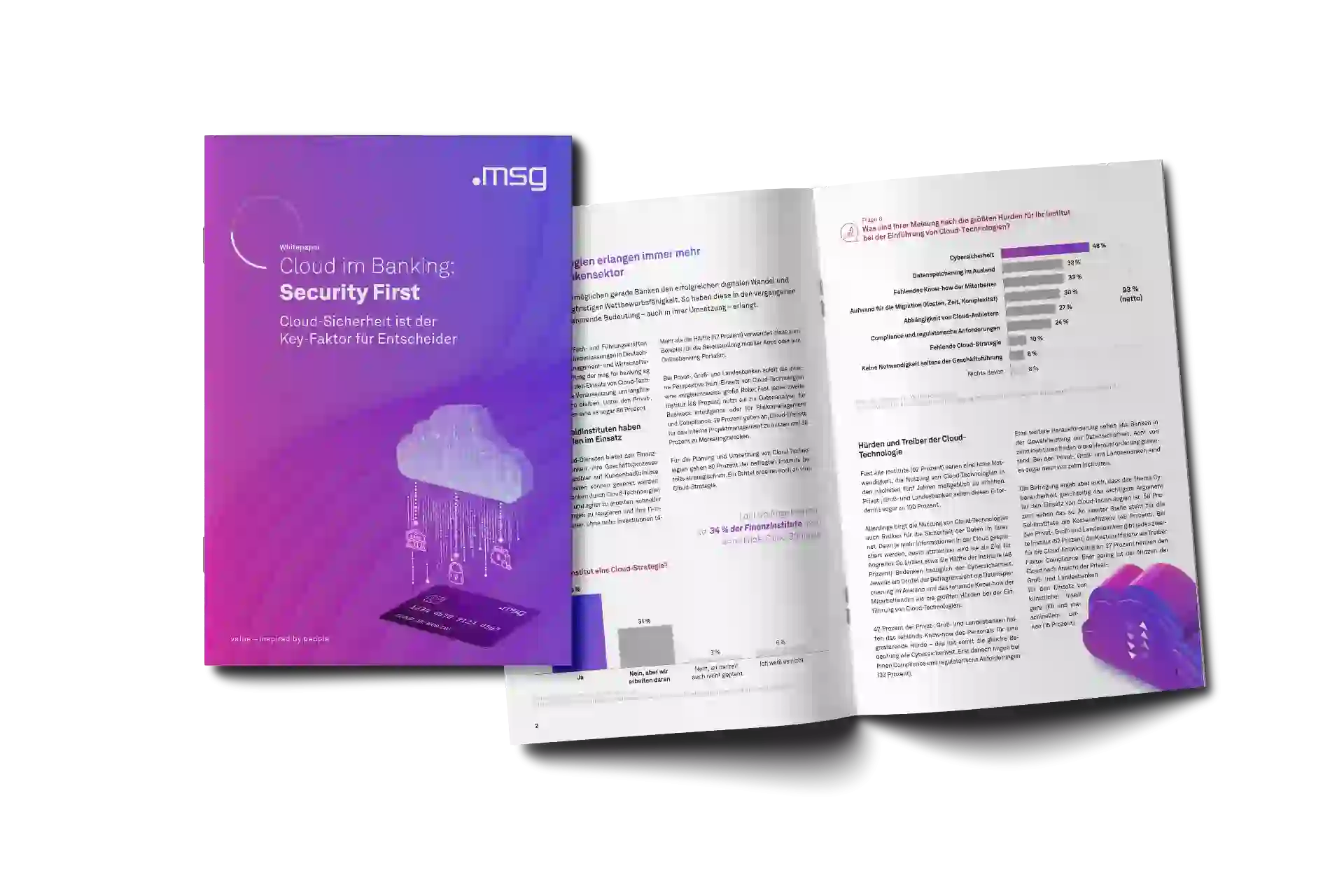

Customer Magazin NEWS 03/2025 AI resilience, i.e. the ability of AI systems to withstand disruptions, atypical situations and attacks, is a regulatory and security necessity. In view of international tensions, particularly in transatlantic relations, credit institutions are increasingly focusing on AI and cloud dependencies outside Europe and the risks arising from them.

Banking.Vision

The hybrid approach ensures both speed and AI compliance. Combining a top-down framework with bottom-up innovation creates governance that follows an agile rhythm – secure, auditable and adaptable.

Banking.Vision

Bottom-up approach instead of blockades: With the bottom-up approach, employees independently identify AI use cases and drive the development of promising AI solutions. This increases motivation and commitment, promotes innovative ideas and creates greater acceptance for AI within the company. From proof-of-concepts (PoC) to minimum viable product (MVP) – practical, fast and compliant with regulations for effective AI use cases in everyday life.

Banking.Vision

The financial sector is required to ensure the responsible, transparent and regulatory-compliant use of AI, particularly in light of the EU AI Act. Effective AI governance in banks promotes compliance with regulations through top-down roles, controls and an eye on European AI regulations. This is how you scale prototypes in an audit-proof manner – with inventory, the three lines of defence (3-LoD) model, model risk management (MRM) and traceable processes.